Strategic investors key to Việt Nam’s international financial centre ambitions: Insiders

Việt Nam’s roadmap to establishing international financial centres (IFCs) hinges not only on planning, infrastructure and human capital, but above all, on attracting strategic investors, according to experts.

Việt Nam’s roadmap to establishing an international financial centre (IFC) hinges not only on planning, infrastructure and human capital, but above all, on attracting strategic investors, according to experts.

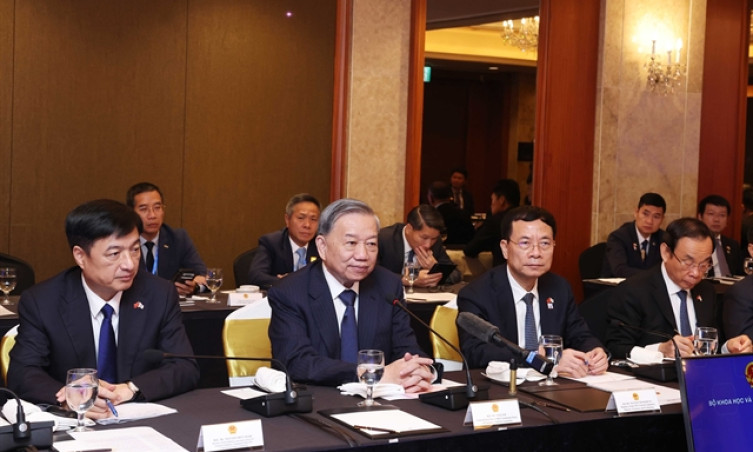

Resolution No 222/2025/QH15, recently signed by National Assembly chairman Trần Thanh Mẫn, lays out a legal framework for the development of IFCs in Việt Nam, with HCM City and Đà Nẵng named as the two designated hubs.

Coming into force on September 1, the Resolution introduces a range of breakthrough and competitive mechanisms to support the centres’ development.

While groundwork such as land-use planning, zoning and infrastructure is being addressed, one of the most decisive factors for success lies in the ability to attract investors, particularly strategic ones.

Recent developments suggest growing foreign interest. Following a US$1.5 billion investment in Hưng Yên, the Trump Organisation has showed interest in developing a project in Thủ Thiêm - the area set to house HCM City’s IFC.

A senior delegation from the organisation conducted field visits and held talks with local authorities to explore the potential site for a proposed Trump Tower, which will include a shopping mall, luxury apartments, a five-star hotel and office space. The company is also eyeing Đà Nẵng, Việt Nam’s second planned IFC location.

According to a recent report by the Đà Nẵng People’s Committee, over 10 investors have expressed their interest and commitment to participating in the development of the local IFC. Notably, a consortium comprising Makara Capital, Terne Holding and Trump Organisation has proposed to become a strategic investor in the Đà Nẵng centre.

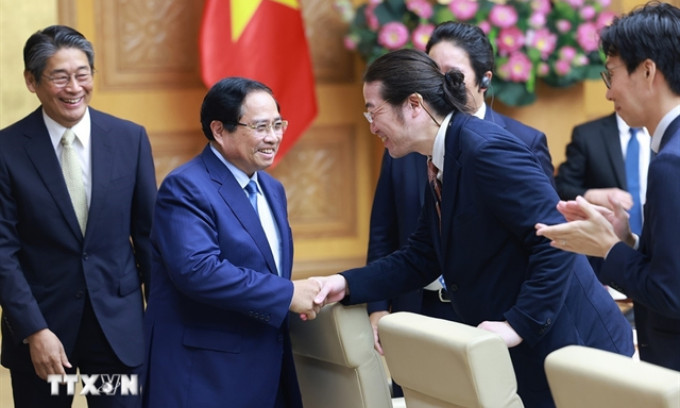

Makara Capital Partners, a leading Singaporean firm specialising in fund management, asset investment and innovative financial solutions, has already built ties with Việt Nam. During a meeting with Prime Minister Phạm Minh Chính in early July 2025, Chairman and CEO Ali Ijaz Ahmad affirmed that Makara had conducted “in-depth” market research and expressed confidence in Việt Nam’s strategic development vision.

Beyond its biopharma industrial park in Hưng Yên (in former Thái Bình Province), Makara also aims to support the restructuring of Vietnamese banks and participate in IFC development. According to Ahmad, the group could mobilise between $5-7 billion to support this effort.

In a separate meeting in March, Deputy Prime Minister Nguyễn Hòa Bình urged Swire Group - one of the UK’s leading conglomerates - to take part in the development of IFCs in HCM City and Đà Nẵng. Swire has already invested in Empire City in Thủ Thiêm, widely regarded as the heart of the southern IFC. The group pledged continued support for the area's development.

The strategic investor imperative

While foreign interest is encouraging, the key question remains - when will these plans materialise, and how can Việt Nam attract the calibre of investors needed to anchor its IFCs?

Nguyễn Văn Quảng, Secretary of the Đà Nẵng Party Committee, recently underscored a broader perspective during a meeting with voters. In his view, an IFC is more than just “a financial office” - it must be a “living ecosystem” where investors genuinely feel it is a desirable place to live and invest.

Finance Minister Nguyễn Văn Thắng echoed this, stating that the goal of building IFCs is to attract international capital flows to serve Việt Nam’s three strategic breakthroughs, support both traditional and emerging growth drivers, and promote high-end financial services. These centres, he said, will also be key to piloting and managing emerging markets in line with real-world demands.

In addition to a “liveable” ecosystem, a thriving IFC requires a robust network of investors. The challenge, then, is not only to build the physical infrastructure but also to create conditions that entice major financial players to establish a base in Việt Nam.

The roles of the two designated IFCs are already clearly defined. The HCM City centre is expected to focus on capital markets, banking, fintech sandboxes, and specialised trading platforms. Meanwhile, Đà Nẵng will test new models such as green finance, sustainable finance, fintech innovation and digital financial services.

Ultimately, Việt Nam’s IFC vision is targeting the world’s top financial institutions and investment funds, seeking to develop a vibrant ecosystem to support digital finance, digital assets and fintech applications.